Why am I paying for my car insurance if I'm not driving?

After countries were in lockdown because of Covid-19, city streets became empty. The number of car trips dropped dramatically. How will Covid-19 impact the auto insurance industry?

"Two weeks ago, together with Sentiance, we started an analysis of the data from our users Pre and Post-Corona period. Based on that information we came up with the following insights:

- Amount of trips and kilometers decreased by 40%

- The total distance of short trips increased

- Use of public transport for commuting to work reduced to 0%

- Fewer people that drive together, so less carpooling

- Fewer people that went out for drinks, dinner, sports, and cultural activities"

-Tony Dingemanse, New Initiatives, RISK

Auto insurance companies have been impacted as people started to wonder:

"Why am I paying for my car insurance if I'm not driving?"

Premium reduction

Some US insurance companies have already decided to offer discounts or refunds for their customers. For example, Liberty Mutual is offering refunds of 15 percent to personal auto insurance customers on two months of their auto premiums. State Farm is giving customers $2 billion in rebates for those who have auto insurance policies with the company between March 20 to May 31. Progressive Insurance customers will receive a 20 percent credit for their April and May premiums. Other insurance companies, such as Allstate, Geico, Nationwide, are all offering compensation to their customers due to the impact of Coronavirus. Admiral has become the first major UK motor insurer to offer its customers partial refunds.

Refunding sounds like a sweet solution for customers. However, is this really a good solution or is it just a quick fix for this unusual situation?

Covid-19 crisis emphasizes a need for Usage-based Insurance (UBI)

The Coronavirus lockdown change has brought a well-known problem into the spotlight again:

"How can insurance companies make sure rates are fair for their customers?"

The lockdown is an extreme case. In our day-to-day life, not everyone is driving the same miles, and not everyone is a careful driver. How can insurers reflect that risk level into their customers' premiums? The Covid-19 crisis emphasizes a need for usage-based insurance (UBI) solution where the insurance package for each customer is determined by:

- How much the customer is driving his/her car - Pay As You Drive (PAYD).

- The customer's driving behavior - Pay How You Drive (PHYD).

"Fremtind has a three-year history with UBI and we are closely monitoring the changes in driving behavior as a result of the Covid-19 restrictions.

The immediate changes in driving appeared dramatic with a drop in kilometers driven and the number of claims close to 50 percent. Now, a month and a half later, the traffic is returning back to normal and it is currently at 85% of the pre-Covid-19 level.

Driving behavior is, in general, good, but at the same time, the amount of extreme speeding has increased. This is also observed by the Norwegian police."

-Henrik Hellerøy - Innovation Team Lead, Fremtind

(Fremtind provides UBI for SpareBank 1)

"Fewer cars" does not mean "Lower risks"

Just because there are fewer cars on the road, it does not mean the risks are lower. The auto premium reduction act has only taken how much the user drives (PAYD) into account, but it did not take the user's driving behavior (PHYD) into consideration. Therefore, the simple solution of auto premium reduction can seem premature.

"The Covid-19 crisis highlights why a simple mileage-based PAYD solution would not be sufficient to model the risks on the roads. Since the beginning of the crisis, most users have been driving significantly less and the overall traffic volume has decreased, but still, the number of traffic incidents has not gone down proportionately.

We need to measure users' driving behavior and use it to promote safe driving. That’s the only way to reduce the overall risk and make the roads safer for all."

-- Arun Ramakrishnan, Technical Product Manager, Sentiance

According to Digital Insurance, In New York City, traffic volume decreased between 78% and 92% compared to January, but there was a 57% increase in speeding violations in the ten days following the Governor’s stay at home orders. And in Minnesota, traffic fatalities have increased by about 50% during a time when traffic was down roughly 50%. In California, during the lockdown, there was a spike in collisions following a downpour and was attributed to people maintaining higher speeds on roads that would otherwise be congested.

In short, the Covid crisis highlights understanding how people drive is more important for risk control than the number of cars on the roads.

Claim resolution under social distancing

Because of social distancing, claim resolutions rely more and more on digital technologies such as photo estimating tools. However, the photographs offer limited insights and fail to capture every aspect of a complex situation leading to a crash. Sophisticated mobile telematics solutions can not only provide real-time crash detections, but also provide a detailed report by analyzing the motion sensor data and associated contexts.

By determining driving events just before a crash (such as a speeding event, an evasive manoeuvre, or distracted driving), insurance companies can find clues to the cause of the accident and help them resolve claims faster.

Post-Covid-19: More private cars, more new drivers, higher risks

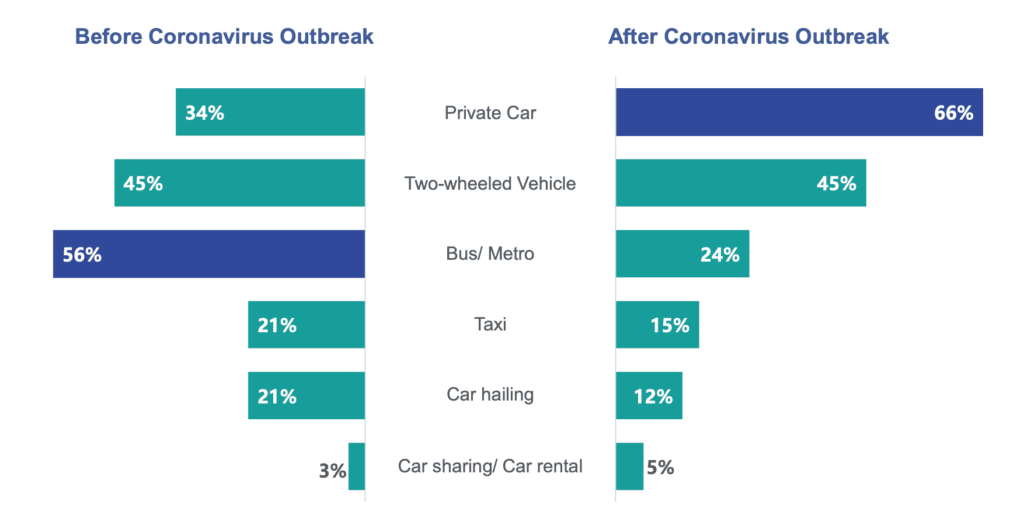

When we look at the data from China, we see the percentage of people who prefer using private cars has doubled after the Coronavirus outbreak. The main motivation for this is to reduce the chance of getting infected on public transport.

As a result, families are getting a second or third private car. It is likely to give a boost in new car sales and second-hand car sales.

CONSUMERS TEND TO USE MORE PRIVATE CARS AND LESS PUBLIC TRANSPORTATION

Image Source: Ipsos | Impact of Coronavirus to New Car Purchase in China

There will be fewer passengers taking public transportation because of social distancing. Therefore, more users will need alternative transport modes, mainly private cars. According to a global survey by Capgemini Research Institute, half of consumers under the age of 35 aim to use public transportation less often and take their car more often in the future.

The risk on the road could be higher, because of more cars, and the increasing number of less-experienced drivers.

Post-Covid-19 impact on auto insurance companies

"At this moment we’ve seen that the amount of trips and kilometers has decreased by 40%. This drop corresponds to the ‘intelligent lockdown’ in The Netherlands where people work from home as much as possible.

Fewer trips and kilometers in combination with less traffic on the road has a positive effect on the amount and intensity of claims. So, in the short term, we will see a positive effect. On the other hand, the trips became shorter, so more people use cars for short trips, which can result in more claims for parking- and paint damages.

In the long term, insurance companies should make decisions about how they should estimate the patterns of the insured people. Within the Post Corona society, people will make other decisions, limit their time for leisure, and traveling. The future becomes more and more uncertain, therefore insurers should develop hybrid models of insurances for this Post Corona time."

-Tony Dingemanse, New Initiatives, RISK

"Fremtind expects an increase in the number of private cars on the road this summer. We already see that restrictions on international travel make people plan for domestic summer holidays in Norway. We expect most of the travel to utilize private cars and it is likely that the average annual driving distance will increase as a result of Covid-19.

We can only speculate on the long-term effects of the crisis. We believe that a fear of infection combined with an increased acceptance of using digital collaboration tools will lead to a decrease in the use of public transportation. In response to this, we may see a general increase in the use of private transportation, and thus also an increased demand for insurance such as UBI.”

-Svein Skovly, Head of Innovation Lab, Fremtind

(Fremtind provides UBI for SpareBank 1)

What can insurance companies do to manage post-Covid-19 risks?

To ensure accurate mobile-based UBI (PAYD & PHYD) measurements, there are 3 key technologies:

- Transport mode classification: Through the motion sensor data of the mobile phone, transport mode classification technology can recognize precisely when a user is traveling by car.

- Driver/passenger detection: An insurance company needs to know whether the user is the driver or the passenger when a car trip is detected. The good news is that with advanced machine learning and AI technology, mobile-based driver/passenger detection technology is available to detect the difference.

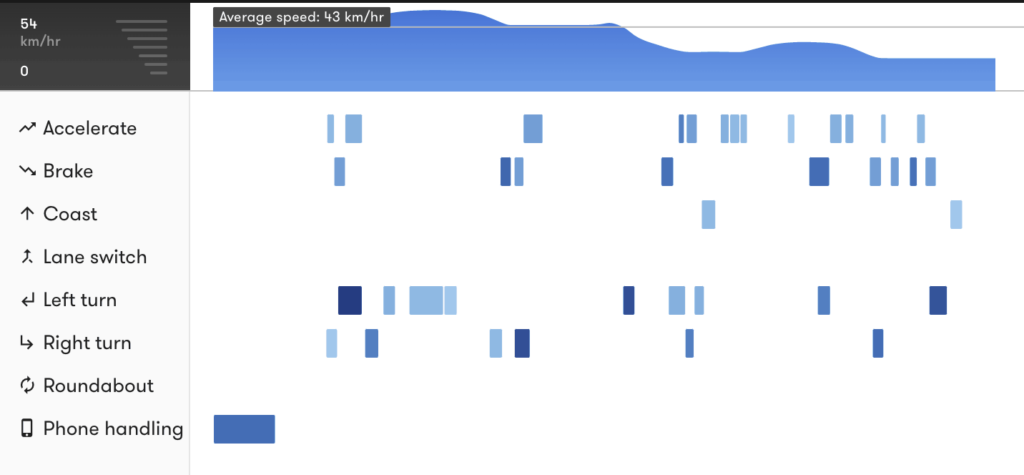

- Driving behavior insights: Intelligent and accurate driving scores to measure driving behavior

Sentiance technology detects drivers' major risk factors such as speeding, hard acceleration, hard braking, and phone handling.

Sentiance Insights Dashboard - Try our demo app to see your driving events.

You can see driving scores for each trip and aggregate scores for the driver.

Test our driver scoring technology, and see your driving scores by using our Demo App Journeys.

"Our expectation is that the Covid-19 will have a positive impact on our UBI projects. People are more aware of their regular expenses and will save money. Within our UBI projects we give a discount based on the driving behavior of the user, so the better our insured people drive the more money they save.

Additionally, our platform detects a lot of information about the behavior of the users. In the Post Corona period, we’ve seen that our users make less use of public transport, also in a society with 1,5-meter distance, the use of public transport won’t be the same as in the past. This creates opportunities for a new concept, what we call mobility insurance. Within this concept, the coverage for the insurance is based on the type of transport, eg. coverage for theft of electronic devices in trains or injury claims for car trips."

-Tony Dingemanse, New Initiatives, RISK

Data-driven risk management is the future

“I suspect Covid-19 will have an ongoing impact on future day-to-day life for a while. The way we work, the way we commute, the way we shop and go on vacation. Here’s the opportunity for insurers to leave the trenches and create new personalized products and services for their existing and new customers. People will work more from home but also the use of private cars will surge, meaning also less experienced drivers on the road at peak times. Pay-per-mile solutions don’t create safe roads, pay-how-you-drive does. And it matches the growing private car use with sustainability. Safety on the road goes hand in hand with safety of the planet.”

- Toon Vanparys, CEO, Sentiance

With data-driven UBI programs, insurance companies can manage their risks better. Customers will be motivated to drive safer to get cheaper premiums. Moreover, it's critical for insurance companies to have the leading technology in mobile telematics with high accuracy, high battery efficiency, and the highest data security to succeed. Are you interested in learning more about how Sentiance technology can bring value to your business? Reach out to our team here today!