The first Belgian bank who bought the media rights to broadcast soccer games in their banking app

Personal Banking will never be the same again. Proof of this can be seen with the recent and exciting announcement that Belgium’s largest bank, KBC, bought the media rights to broadcast Belgian soccer goals and highlights in their mobile app, because soccer is the prime activity and entertainment sport in Belgium.

This is not the first time we’ve seen bold moves like this either, Tinkoff, in Russia, has purposefully built a super app that provides customers access to their growing ecosystem of financial and lifestyle services. OTP Bank in Hungary allows their customers to purchase train tickets in-app. Revolut allows its users to trade stocks and cryptocurrencies while providing access to exclusive airport lounges.

Serving your customers beyond your core offerings

Why?

Look no further than the billion users WeChat has using their mobile app every day. Instead of remaining just a messaging app, WeChat rapidly kept users coming back for more by creating a lifestyle of commodification and convenience through combining multiple, relevant, functions that provide its users with third-party services, including buying movie tickets, hailing a cab, ordering food delivery, paying utility bills, or sending money to friends. In fact, it’s not unusual for a WeChat user in China to plan a date with a friend via instant messaging, make the lunch reservation, order a taxi and pay for every transaction along the way, all using one single app. It almost feels like a lifestyle partner that knows and meets all your needs. As we know, the more value you can provide your customers, the more they'll engage with your products and services.

The mobile phone as a proxy to your customers' real-world lives

With everyone carrying a mobile phone in their pocket, companies are constantly competing for peoples’ limited time and attention. The way to win the game is to create relevant engagement and offerings for your users, and make their life easier. The more time users spend in an application, the more that company can learn about that customer and provide more relevant products and services that deepen engagement, or better said, increase loyalty.

Companies across industries are attempting to create ecosystems where people want and need to spend time. Banks, and certainly the neo-banks, have understood that message and need to create hyper-personalization at scale using the power of smartphones.

How much do banks know about customers?

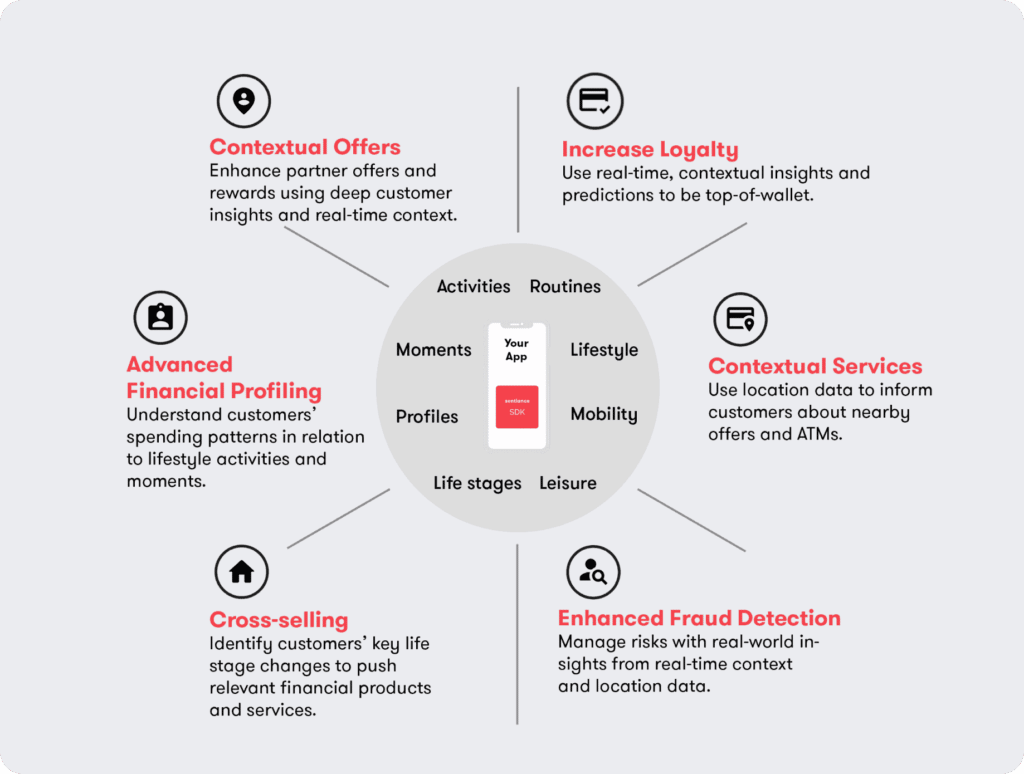

Knowing your customers nowadays is more than just a fact sheet, it's about knowing your customers' lifestyles, personal preferences, life stages, and much more. The secret weapon that the likes of WeChat have, and banks of the future need, is real-time and real-world understanding of who their customers are as they move through their everyday lives. These behavioral insights are crucial for creating relevant engagement and contextual offers to retain your customers.

"It is about understanding the life journey of customers. It is about understanding the frictions in the life of the customer. Once you have a clear view on their dreams and fears, you can create solutions that go beyond transactional convenience."

-- Steven Van Belleghem, A thought leader on the transformation of customer relationships.

It’s not just super apps like WeChat, but the neo banks, too, that will disintermediate banks from their customers by providing a simpler, yet more personalized banking product, that better target financial products to customers, at the exact time they need them. This rise in competition from these agile fintech and neo banks as well as the increase in a fickle customer always looking for the next best thing has meant that now more than ever, retail banking needs to find ways to know and engage the customer. Read any of the more recent reports from the likes of PWC or Deloitte on the future of retail banking. You’ll be well aware that seamless and personalized service is what it will take to win and keep the customer of the future.

A contextual banking experience: customers are offered the right products at the right moment.

Imagine, you are about to go home after a long working day. It is pouring outside, you start to feel hungry, but you don't feel like cooking. Just at that moment, you received a notification from your banking app, and you are offered 30% off when ordering takeaway from their partner restaurants.

Imagine, when you are going on holiday and arrive at the airport for departure, you would receive a message from your bank, reminding you to turn on travel insurance.

After arriving in the foreign country where you’ll be staying, your bank notifies you where you can draw cash without charge, and be rewarded for swiping your card at partner hotels and retail stores.

Imagine a holiday when your bank offers you an interest-free 30-day overdraft just as you need it.

At the end of the trip, when you arrive at the airport to return home, you are offered free airport lounge access and the opportunity to join your bank's premium travel rewards program.

This is hyper-personalization at scale. Are you ready to provide a user experience like this?

Hyper-personalization at scale, powered by ethical AI

"Retail banks are investing in digital technology and collaborating with third-party providers to drive customer centricity and stay competitive within an evolving banking ecosystem."

-- Top Trends in Retail Banking 2020

The smartphone is a proxy to a person's real-world existence that when used correctly, becomes an insights platform that can achieve personalization at a scale.

The Sentiance motion intelligence and behavioral change platform enables banks to get a deep understanding of the individual user journey, from lifestyle to driving habits, from personal hobbies to life stage changes. Hence, retail banks can create hyper-personalized products and services that engage users on a one-to-one basis with an unmatched focus on privacy and data ownership.

For today’s retail banks, it's not enough to have a digital presence. It's time to invest in creating a truly engaging digital experience beyond transactional convenience. Today, Sentiance technology is already behind the world's leading companies across industries to help them create personalized engagement, improve user experience and increase retention rate. Are you ready to offer more to win your customers' loyalty? Let's have a chat.