When I was pitching my startup to investors, a common question was, “what if the FAANG (Facebook, Amazon, Apple, Netflix, Google) enter your industry?”. Such questions were often asked by rookie venture capitalists, but we diligently pleaded why ours was an unlikely target market for the tech giant.

I had not heard this what-if question in my time consulting large enterprises, and it appeared they operated on a belief that a big tech company would never succeed in their industry.

As “software eats the world” and more industries are disrupted, this question is becoming a priority area for leaders of incumbents and challengers in many industries. "Software is eating the world" is no longer a headline from Netscape founder Marc Andreessen for what is to come, but an accurate depiction of an on-going global transition.

“We always overestimate the change

that will occur in the next two years,

and underestimate the change

that will occur in the next ten.”

- Bill Gates.

Leading this change are dominant technology companies with two distinct qualities.

- Network effects (each additional user improves utility exponentially).

- Marketplaces (multi-sided markets) which enable these companies to leapfrog the incumbents in any industry.

Advancements of dominant tech players using network effects and market places, are leading to cross-industry competition. This is leading to a race on personalization, privacy, and emergence of data as the new currency.

We also share some ideas on how incumbents can innovate to disrupt their industry before they are disrupted.

Cross-industry competition

The game has changed. Fast food restaurants don't fear McDonalds. Instead, they are afraid of Uber Eats. Netflix closely monitors HBO & Disney, but it's Fortnite that keeps them awake at night. Big traditional banks are also facing the FAANG financial revolution.

Image Source: Presentation for V4 Future Sports Conference 2019

The dominant tech platforms have effectively started serving existing industry players with products like AWS, advertising, and developer tools that drive a large portion of recurring costs for new companies & products.

A shift is also underway to pick up more substantial parts of Enterprise operating expenses, e.g., Microsoft and Amazon were the big contenders for the US Jedi $10B Cloud Modernization contract, which was ultimately won by Microsoft.

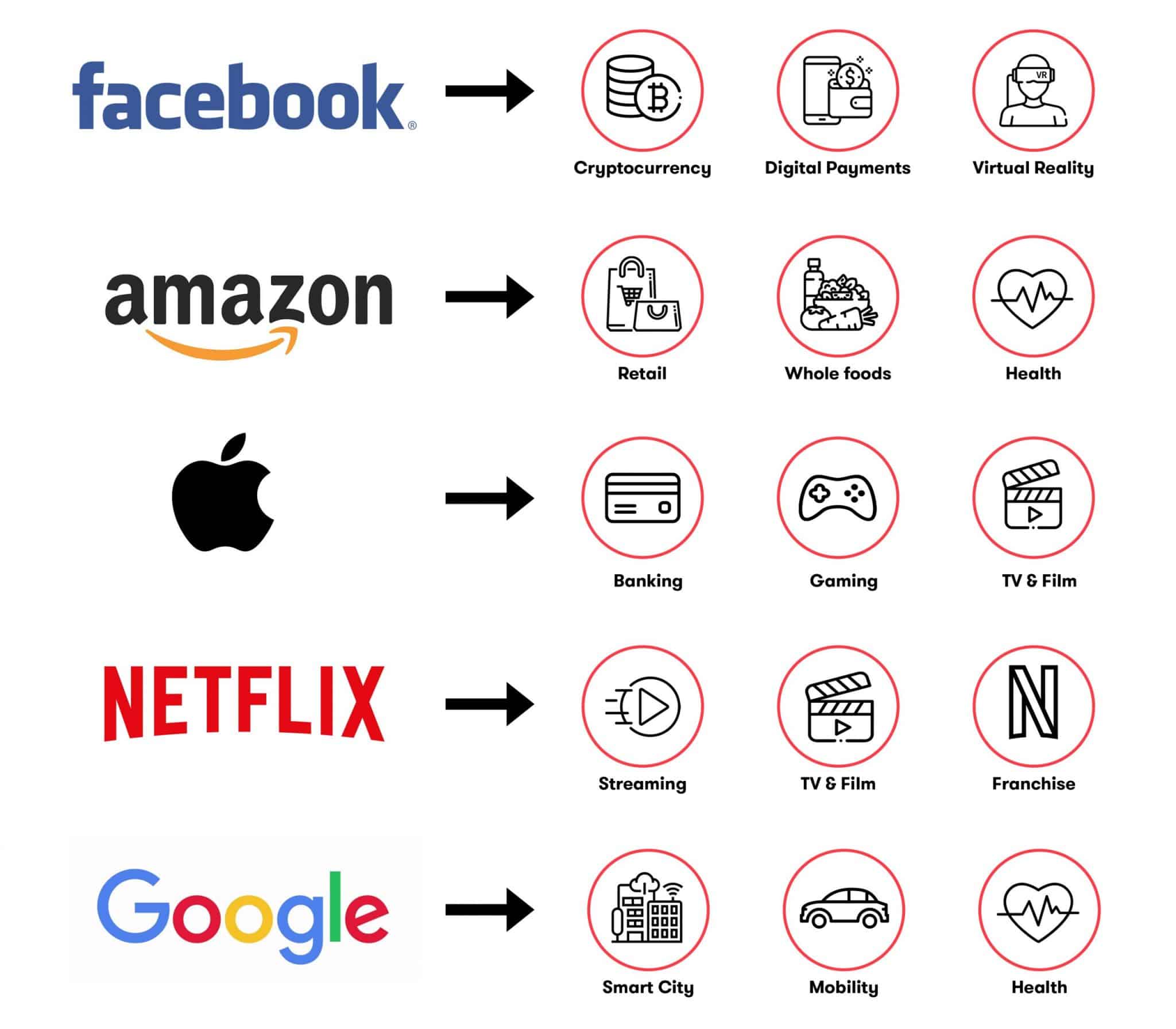

Here are some of the areas of interest for dominant technology companies:

What happens to the consumers?

A common question at Board Meetings from our clients often is "What happens to our consumers?", but the reality is most companies have limited interaction with their consumers on a regular basis. This has enabled tech players to win and often monopolize their target industry with a highly personalized, technology-enabled experience.

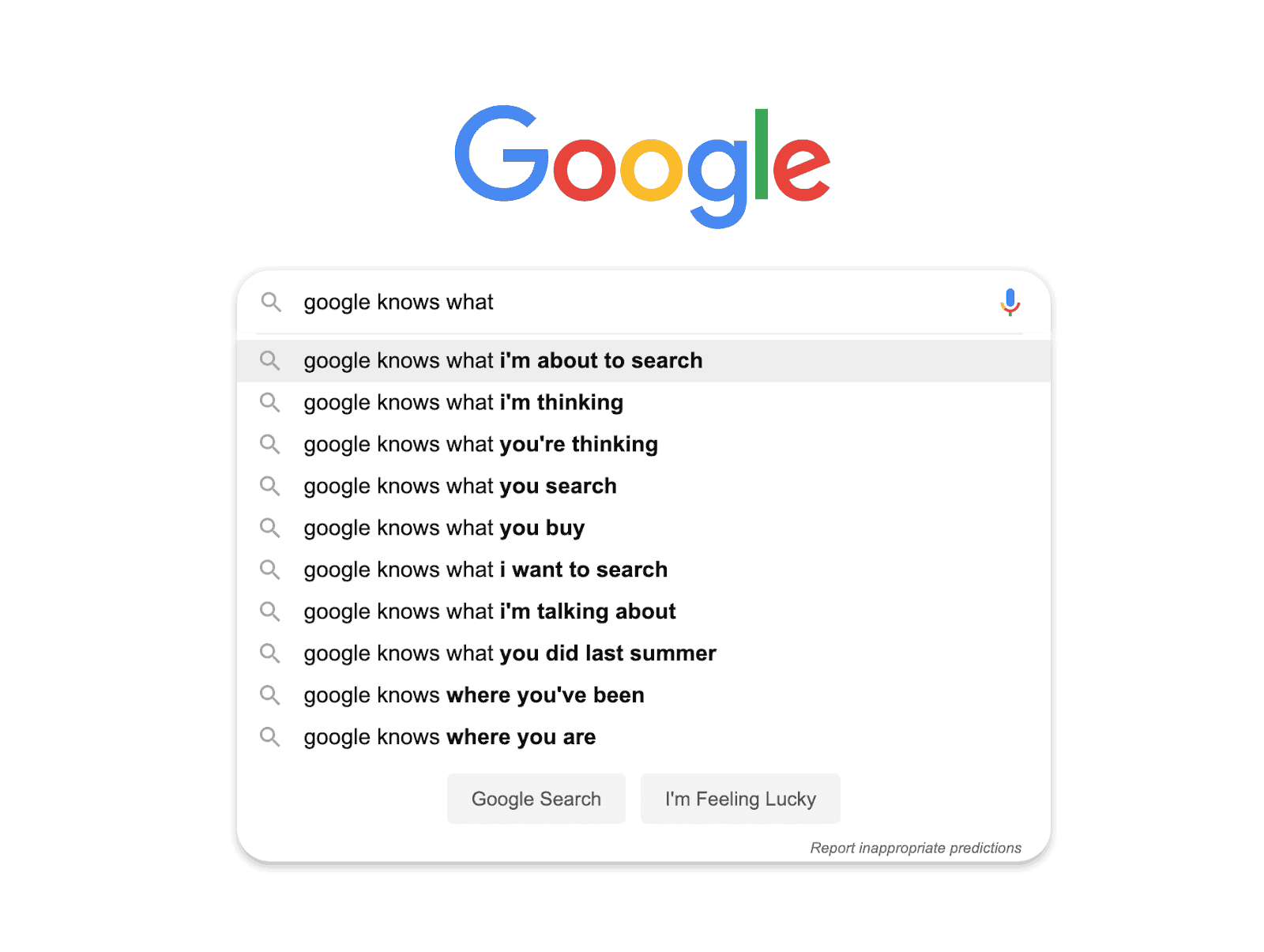

Consider this example: from a consumer perspective, I would be quite pleased with the experience if Google provided my car insurance since they already know my routines, travel, transport modes, plans, and driving habits thanks to Google Maps, Gmail & Calendar.

Therefore, they could offer me a tailored insurance plan with simple terms and conditions, plus a usage-based pricing plan, and coverage all over the world instead of a specific state/country. It would use machine learning to help me become a better driver & avoid unsafe driving conditions, e.g., too tired to drive or hazardous road conditions (suggest to work from home).

Compare this with the broken experience of the current insurance provider, where I only contact them when I need to renew/have a problem. It would obviously be better to have a self serve and personalized option.

From a big tech company point of view, FAANG find fragmented industries with low customer satisfaction (Net Promoter Score) and consolidate (roll them up) with a well-designed software/abstraction layer that takes complexity away, and passes on some value back to the consumer.

An interesting example here is the Apple Credit Card was launched at a time when traditional credit card companies were busy ‘innovating’ a commodity product with points & interest rates.

Instead, what Apple offered as a product was privacy, customer service, together with better rewards and rates. They also added one more thing, a way towards responsible spending, which fundamentally alters the traditional credit card model.

What can traditional companies do?

In response to such threats, many traditional companies have created Innovation as an agenda item and organize themselves to work with startups.

This innovation effort is typically led by a ‘sneaker & slides’ executive (someone who can make fancy slides about internet 4.0, AI, blockchain disruption, etc. and increase their budget without anything tangible to show for it). A good signal for them is a disproportionately high number of buzzwords/minute. These people are most often found at conferences, wasting precious time of early-stage companies.

These labs scour the market for interesting ideas and startups who can help them compete with the giants.

In most cases, innovation teams create less value than they capture for a variety of reasons, including board focus, ability to recruit builders, scaling prematurely, and focusing on things other than customers.

In my experience, incumbents are better off funding spin-outs as sole investors, since that better simulates the real-world founder pressures on the “executive-founders”.

While large companies focus on optimal organizational design for innovation, software is still eating the world, and executives in charge at large companies should be worried.

There are good reasons for being worried. Consumers are generating more and more data, and demand for more personalized products is on the rise. There is also an increasing amount of personal data on the internet, allowing advertising engines & companies that already have consumers' data to predict what they are doing to be doing next.

Data is the new currency

There has been good work on privacy, starting with Europe and GDPR. Large tech companies have quickly become the guardians of privacy. Because it benefits them since they already collect data, and these rules make it harder for someone to challenge their market dominance.

For an internet that was designed to be open, we are all part of one walled garden or another, which we have to pay increasing amounts for as we generate more data.

As this market plays out, there are clear winners in the form of FAANG and their associated entities. They have a great business strategy and have made investments in many areas directly (Google – Waymo) and indirectly (Uber) to ensure upside as we go through this next phase of a technological revolution.

New entrants in markets are growing rapidly, and companies that can drive a little bit of value can grow at 3-4x the industry average. They deliver a much better solution to a long-standing problem, e.g., how to make driving safer, to reduce risk, and claims paid out.

Often incumbents who build innovation teams do so with mostly limited success or have defaulted to an inorganic growth strategy buying what works and then attempting to bolt it on to their existing products.

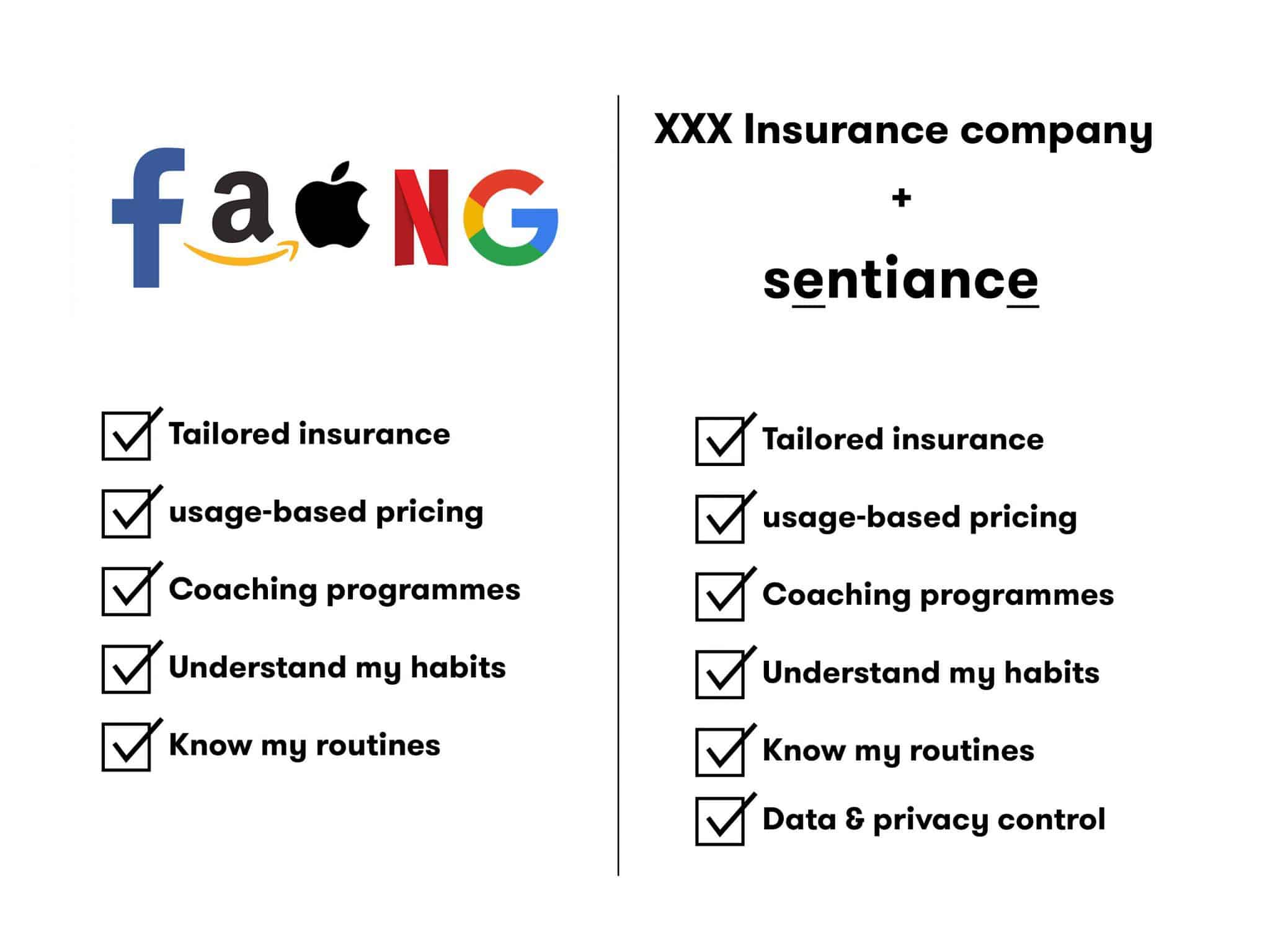

Innovate with Sentiance

Sentiance is a data science and behavior change company. We help traditional industry players & challengers level the playing field by giving them access to leading machine learning technology, ethical AI-generated context, and behavior change techniques.

These companies can make the most out of their data securely and effectively, deliver services with personalized experiences while protecting users' privacy, which consumers have now come to expect for "free" from the dominant technology platforms.

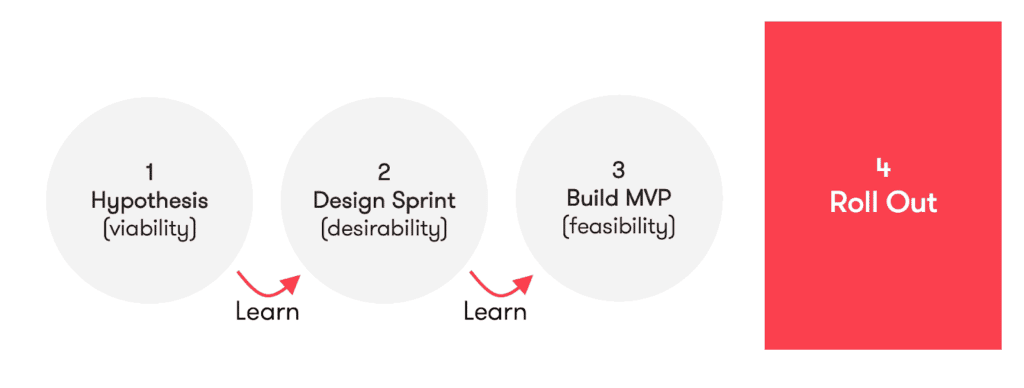

We help our clients with a methodology that combines strategy, product discovery, innovation, and monetization in an ethical and sustainable manner, delivering value to all players involved.

Sentiance partners with big companies who are thinking and acting ahead, and also those who are struggling to keep pace with rapid innovation from startups.

The ultimate innovation goal is for incumbents to disrupt themselves before someone else. By giving their customers personalized services, companies become relevant to their customers. Respecting data protection and user privacy builds trust between these same two parties.

For any solution to work, it has to ensure that incentives are aligned across the stakeholders. For example, it must solve a real problem, and show quickly that we can deliver a much better solution to that problem using the combined talents of new tech and existing distribution.

It also must demonstrate that new technology and existing machinery can drive value together and get the right data/learnings in quickly to ensure that the project wins in the competition for resources.

For a large company, they need to do the following to win.

Deliver value for our clients

Sentiance clients are always in control of their data and get hyper-personalized services.

We've worked with several large companies in the past years, and we have the skills of a top strategy consulting firm to help drive the right insights and focus areas - without having to sell time.

In Sentiance, we also have a skilled product discovery team - without having to shoe-horn a specific product into the solution. Our teams help arrange the necessary ingredients for the best solutions for solving clients' challenges.

We have the skills of a roll-out team - to help integrate and scale with existing systems - while keeping skin in the game as we get paid when our clients make money.

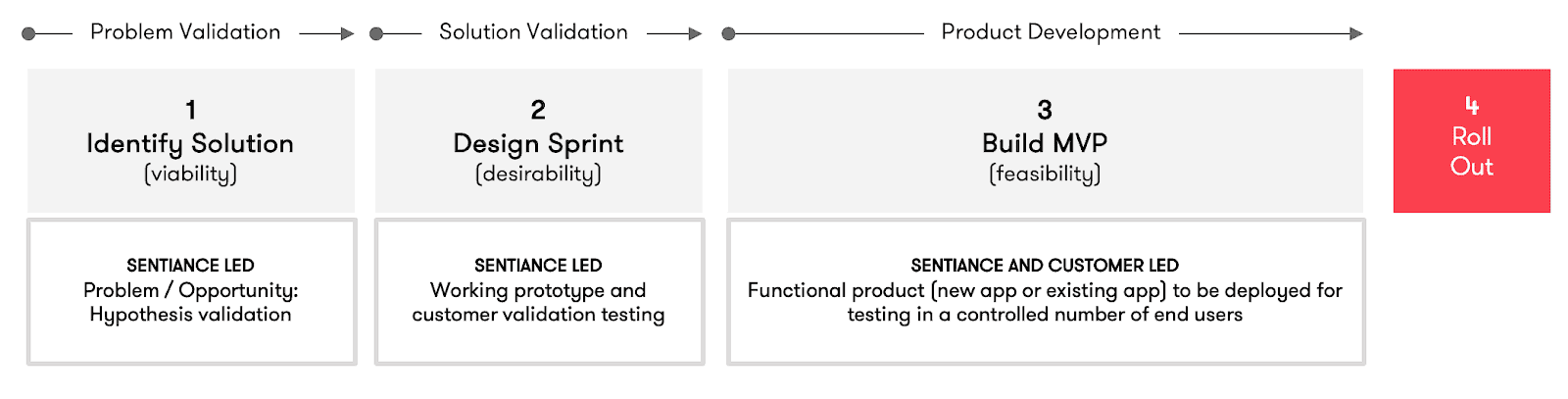

Below is the flow of how we deliver value for our clients. At the core of our work is our desire to find the truth about customers' needs, and magically deliver that as fast as possible.

Let's innovate, and build something amazing together!

Please feel free to reach out if you have questions or comments.