One of the challenges of insurance companies has always been developing a more meaningful mutually beneficial relationship with policyholders. Advancements in technology in the recent decade resulted in abundant data which created an unprecedented opportunity to overcome this challenge.

Many carriers and brokers are leveraging telematics data to create more precise risk and pricing models that underpin new usage-based insurance (UBI) products. Now that group behavior (e.g. demographic-based) and proxy variables (e.g. credit score) are not enough anymore. Mobile telematics and other behavioral data are necessary to create a more accurate driver profile. This not only benefits insurers by providing better risk assessment, but also could lead to more satisfied customers because of personalized pricing.

However, in a deeper layer, the core concept of UBI is having that deeper customer relationship with UBI users. Fast-changing consumer demand including connected lifestyles resulted in a convergence of new consumer-centered business models in the auto insurance industry. The digital natives will increasingly expect seamless, omnichannel, real-time interactions and experiences. According to a recent Cognizant insight report:

“the insurance industry is at the cusp of disruption, driven by a combination of nimble start-ups using emerging technologies and new data source to serve evolving customer preference” (1).

This is forcing insurers to change their approach to product design, pricing, and distribution in ways that leverage all available data. Therefore, collecting, analyzing, and implementing behavioral data drives innovative product offerings and growth. Think about it and answer these important questions: How well do you know your policyholders? And how much your products are adapted around their lifestyle, patterns and behaviors?

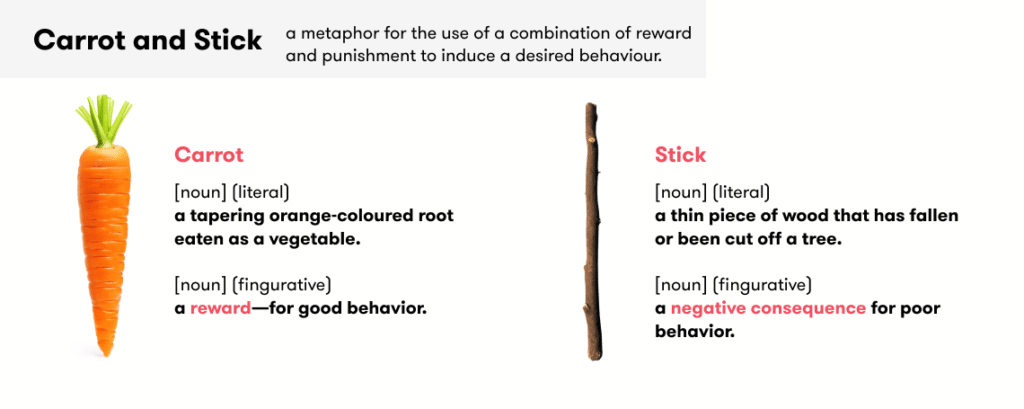

To answer these questions you may want to know how much your products are based on data-driven behavioral science. There are many insurance products using the old carrot and stick approach to change the behavior of users. Is that all behavior science can offer? And Does that even work?

We know for a fact that extrinsic motivation such as financial incentives helps in adopting UBI and positively changing driving behavior, but it only works for a short period of time. In fact, any behavior change strategy which relies only on the extrinsic motivation of users is inherently unable to create long-term change. Driving is a complex behavior. Thereby the carrot and stick approach might not effectively influence the users to avoid risky behaviors in the long run. There are a few important points on how to develop and improve your UBI products from a behavior science perspective:

Number 1. Self-monitoring

For the users, the driving score in your app has a totally different meaning than it does for you as an insurer. A good user-facing score is designed to have the needs and emotions of users in mind. On the other hand, a driving score for risk models and pricing models does not include any coaching and engagement elements. It is merely considering risky driving events such as speeding, phone distraction, harsh events, etc. Therefore, we strongly recommend not using user-facing scoring to detect risky drivers for pricing. The purpose of driving score from a behavioral perspective is to provide self-monitoring for the user. This score in addition to trip information (e.g. time and trajectory) and other contextual insights (e.g home to work trip) helps users to know where, when and how much they were driving risky. Driving score should consist of a few key characteristics:

- Easy to understand and aesthetically appealing

- Does not fluctuate much with one bad trip so it does not disappoint and leaves room for improvement

- Relevance to the risky behaviors you are monitoring, to the user, and also in relation to other users or a norm

Having said that, you may realize that self-monitoring does not necessarily need to be visualized as a score. There are other ways to provide feedback to the user about their driving behavior and help them to improve it.

Number 2. Behavioral design

The design of a successful engaging UBI product starts with user research and getting to know your users. Not many insurers have quantitative data on the risky driving behavior of their policyholders. You may want to start with qualitative methods such as surveys and questionnaires. However, you have to be aware of the natural limitations and biases of insights collected through qualitative methods. Then, the user journey and user experience should go through an iterative design and development process based on your findings and evidence-based behavioral techniques.

Make sure in a user-centered design to build trust so the users don’t churn. For instance, be transparent about the mistakes your technology might make and be prepared to take feedback and correct them. The added value of giving location permission and allowing you to track their driving behavior should be clear for the users from the first seconds of downloading the app and preferably visualized in the app.

Number 3. Intention-action gap

We know smoking or speeding is dangerous yet many of us still do it anyway! Knowledge can not guarantee action. In fact, only a fraction of users in any given cohort of users could immediately benefit from self-monitoring and awareness-based strategies. This means that self-monitoring and added values like personalized pricing based on their scores can only keep your UBI users engaged for a while. Also, financial or virtual incentives could help users sitting on the fence to join and engage in the short run, but their effect mostly fades away. So, what else is in our behavior science toolkits you can use to improve retention and deepen your mutually beneficial relationship with UBI users?

The answer is proactively coaching UBI policyholders to drive safer. That is how we can bridge the real gap between being aware of the risks and taking active steps toward preventing those risks. Designing evidence-based strategies to decrease the perceived effort of safer driving and increase self-efficacy and self-control as app features will result in improvement in driving behavior or risky drivers and more reasons to stick to the app. For instance, incorporating some elements of gamification into app features, such as challenges, leaderboards, and visualizing progress could help users practice goal planning, self-control, and form habits. By engaging users and actively coaching them, they transform extrinsic motivations into intrinsic motivations and become better drivers.

Building a deeper relationship with your UBI users

At Sentiance, we are focused on leveraging behavioral data into creating a meaningful and mutually beneficial relationship between you as an insurer and your UBI users. This is the key to having loyal customers and lower claims as it is shown to both increase UBI adoption and make positive changes in users' driving behavior (2).

References: 1- Catching the Consumer Data Wave: A New Opportunity in the Insurance Ecosystem (reference link)

2- Soleymanian, Miremad, Charles B. Weinberg, and Ting Zhu. "Sensor data and behavioral tracking: Does usage-based auto insurance benefit drivers?." Marketing Science 38.1 (2019): 21-43. (reference link)