Why telematics doesn't work

There’s a lot of skepticism in the insurance industry that telematics can supplant traditional measures of risk such as credit rating, occupation, and the like. So far, the empirical evidence supports the doubters. Root, the largest telematics-powered auto insurer, has higher loss ratios than established players. While offerings from other insurance companies using telematics have made only modest progress, published actuarial data suggests their models are only mildly predictive.

So… why is that? And does that mean that telematics is not working UBI?

Why is easy: It’s because traditional firms have been unwilling to change their business models to embrace telematics. Everyone — pretty much — does it the same way: “Drive really well and you could earn up to a 30% discount.” Leaving aside the fact that it’s a terrible consumer proposition (“you could…”). This means you’re only using telematics to measure a really narrow range of risk outcomes. Your best and worst drivers — telematics-wise — are separated by a scant 30% gap.

And while it’s bad for consumers, it’s even worse for the insurance company. As prices don’t rise for bad drivers. Better drivers pay slightly less, while worse drivers pay about the same.

How we made it work for

At Just Insure, we started with a few simple axioms:

- Telematics needs to be about changing driver behavior to make the roads safer. The focus needs to be on identifying risky behavior, not just on reducing the rates slightly for people who exhibit “anticipative braking.”

- Risk is the combination of where and when you drive, how you drive, and how much you drive. The greatest risk is at the intersection of these — speeding on dangerous roads when it’s raining, busy, and dark is much worse than going a little quick on the freeway on a sunny Sunday morning.

- Identifying the worst risks — and pricing them accordingly — is the best way to lower prices for better drivers. In other words, we want to identify people who are more likely to have accidents.

This means that our product doesn’t look like a traditional auto insurance product. We don’t care about your credit score, your highest level of educational achievement, whether you’re a chef or an accountant, or your marital status.

To get a quote with us requires just the information on your driving license (which we’re happy to scan from your phone), the type of vehicle you drive, and for you to confirm your accident, claim, and violation history.

The price we give you — which is a per-mile one — is then good for 30 days of driving. In that time, we measure your miles, your driving habits, and where and when you drive. After 30 days, we (most of the time) offer a new price, which could be higher, lower, or the same.

In other words, we are able to reprice our customers as we learn more about them.

Does it work?

Yes.

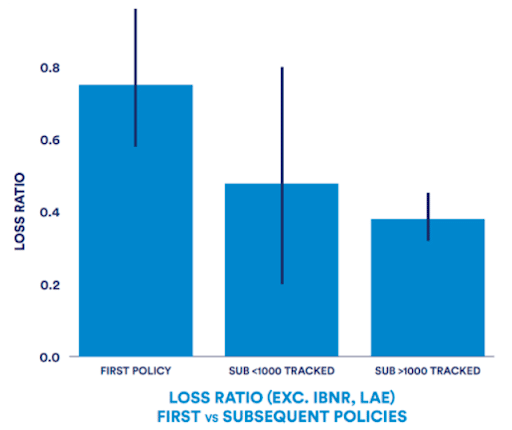

As we learn more about our customers’ driving habits, we price them better than any other auto insurer. We do this without the use of discriminatory measures like credit scores. The chart below, which covers all the premiums and losses since we launched in 2020, shows where we are:

People in their first policy period (30 days), about whom we know nothing, have the highest loss ratios — somewhat worse, in fact, than GEICO, Progressive, or other traditional auto insurers.

But as we learn more about our customers’ driving, our pricing gets better and better. When we know a little bit, our loss ratios drop to about 50%. And the policies we issue once we have more than 1,000 tracked miles have extremely low loss ratios.

Condition-based driving behavior

We take the conditional-based driving behavior into consideration. As Robert Smithson, the Founder and CEO of Just Insure, says,

"The key, though, is to change the question: it’s not a case of is the driver behaving well? Instead, we prefer is the driver behaving appropriately, given the conditions? Good drivers change their behavior as the conditions change. Bad drivers do not."

We use Sentiance's mobile telematics SDK to not only understand driver's driving behavior but also each trip context. UBI should stand for "user-based" insurance, and not "usage-based" insurance. Insurers need to continuously evolve their UBI approach if they are to get the most out of telematics data to mitigate risks and reduce claims.

"We are delighted to work with innovative companies like Just Insure, as they rethink and redefine the UBI of tomorrow."

says Oliver Bath, Head of Customer Success at Sentiance.

Doing the right thing — pricing people according to things inside their control — is good business. It is fairer, it makes the roads safer, and it is more profitable than traditional auto insurance.

Lessons we learned

If there’s one thing we’ve learned, it’s that making telematics work for UBI is not simply a matter of buying a better pricing model off the shelf (and I’m sure there are some excellent models out there… even if ours is best). Other insurers need to do what we did and reimagine their business model around telematics.

If they do so, then they can do what we did: Make the roads safer, save our customers money, make insurance fairer, and make the best margins in the auto insurance industry.