Rapid Changes in Mobility

COVID-19 has changed the way people will move for the foreseeable future. What does this change in mobility mean for the insurance and transportation industries? What new models are emerging?

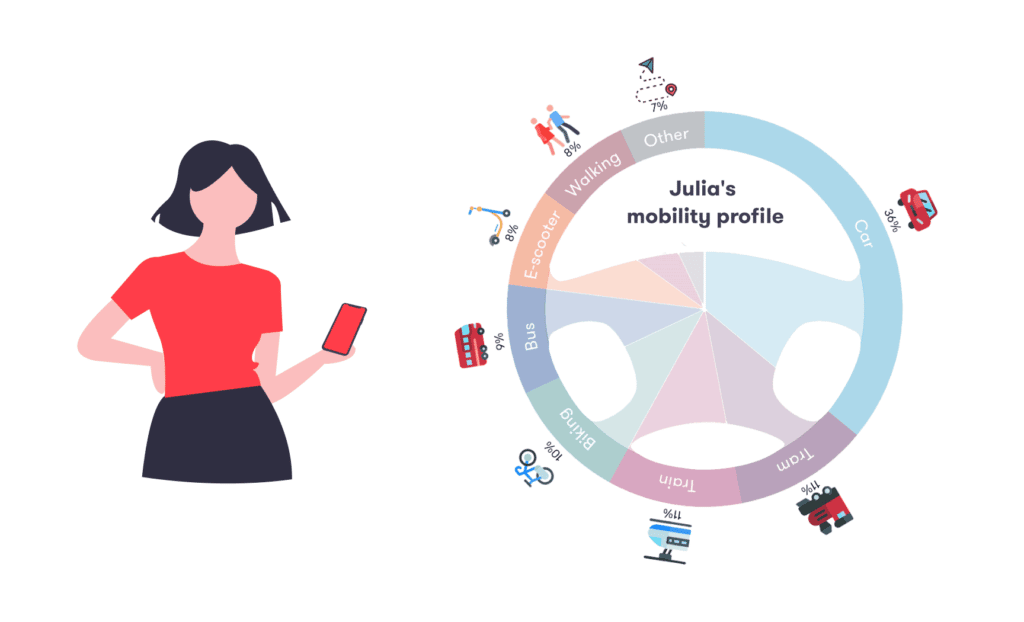

Although mobility across the board is down, the mix of modality based on each individual's new life has changed. Some people are driving more instead of taking public transport. Some people are driving less because they now work from home. The rapid change in mobility behaviors has been accelerated by the convergence of factors that range from the seismic shift to remote working, people's inherent concern about coming into proximity with others, increasing awareness of sustainability and healthy lifestyles, and of course the abundance of shared mobility services in urban areas.

Opportunity for Insurers

These rapid changes in mobility present a challenge, but also an exciting opportunity for the insurance and transport industries. There is a shift from predictable, one-dimensional mobility routines, to dynamic usage across multiple transport modes and services. This requires a real-time measure and understanding, on a per-person basis, of which transport modes someone is using, when and how they are using them. Thus, there's a need for delivering flexible and risk-aware mobility and insurance services for these new post-Covid consumers. With the technology available today and a smartphone in every consumer’s pocket, we are starting to see more and more exciting new insurance offerings, such as Mobly, offering multimodality policies and pay-per-mile products such as King Price Insurance.

What will auto-insurance products look like in 2025? Will there be auto-insurance as we know it today? For insurers to stay in the game, they will have to build on these new trends and cover more than just one modality in the policies they offer.

What will auto-insurance products look like in 2025? Will there be auto-insurance as we know it today? For insurers to stay in the game, they will have to build on these new trends and cover more than just one modality in the policies they offer.

Pay How You Move: hyper-personalized mobility insurance

Mobile telematics has opened up new business models like Pay As You Drive (PAYD) and Pay How You Drive (PHYD). UBI insurance allows insurers to charge based on each customer's actual driving habits. But what comes next?

Mobile telematics has opened up new business models like Pay As You Drive (PAYD) and Pay How You Drive (PHYD). UBI insurance allows insurers to charge based on each customer's actual driving habits. But what comes next?

Pay How You Move enables customers to be covered when taking all types of transportation, such as bus, train, bike, car, scooter, and more. Insurance companies will offer a hyper-tailored premium based on the individual's fluid mobility behavior:

- What modes of transportation customers are taking/using

- How much/how long (miles) customers are using it

- How safely customers are driving (behavior-based)

There are many features for insurers to build out a unique Pay How You Move offering, such as reward sustainable mobility behavior, monitoring CO2 emissions, reward safe drivers, covering physical injuries when using MaaS, covering loss/damage of property when using public transports, covering canceled train trips, etc.

A shift from Vehicle-centric to Human-centric

The fundamental principle behind Pay-As-You-Move mobility insurance is a shift from insuring the single vehicle towards covering an individual across multiple modes of transport.

Combining a human-centric approach with business strategy—rooted in data and analytics—is key to growth. According to Accenture, 89 percent of C-suite leaders acknowledge the value of embedding this combination at the heart of their business.

With the rise of shared mobility, increased focus on sustainable mobility, and a shift towards flexible workplaces, it is a perfect time for insurance innovators to further develop personalized and flexible insurance products that match these new mobility lifestyles.

The benefits of Pay How You Move

Insurer benefits:

- Increased customer acquisition. Insurers can expand their customer base from "car owners/single-mode insurers" to "mobility users".

- Increased customer retention. This is a flexible insurance solution that adapts to people's changing mobility profile. Even when someone sold his/her car and moved to the city, they will still keep their mobility insurance.

- Manage risk better. By understanding the complete mobility behavior of the customers, insurers can better manage risk on a per-person basis.

- Actively contribute towards sustainability. A better understanding of a customer’s complete mobility profile enables insurers to proactively encourage sustainable mobility (walking, biking, or public transports) while reducing exposure to risk.

Consumer benefits:

- Personalized pricing. Consumers enjoy personalized pricing tailored for their dynamic individual mobility behavior.

- Single policy management. Instead of having to manage multiple policies, customers can now have this personalized single policy that covers all of their mobility.

- Value-added mobility features. A full mobility profile enables the customer to receive exciting and valuable mobility features such as coaching, family safety, carbon tracking.

A safer and sustainable world

In our fast-moving world, we see a promising alignment between insurers and the insured for a safer and more sustainable future. With today's technologies and aligned intentions, everybody can be the benefactor of new and exciting insurance models like Pay How You Move.