Telematics, known at Sentiance as motion insights, is transforming road safety within the insurance sector. In this blog post, we uncover how insurers are cutting double-digit percentage points off both their claims ratios and expense ratios.

Originally just linked with Usage-Based Insurance (UBI), expanding the use of telematics to all 2-wheeler and 4-wheeler auto insurance customers, regardless of policy type, not only promotes safer driving behaviors across a wider audience but aligns with global efforts to reduce road traffic fatalities, currently at 1.19 million annually!

Beyond safety, let’s explore the other benefits of extending telematics (motion insights) to everyone in your portfolio:

1. On-device motion insights for lower costs

Sentiance’s on-device telematics enable insurers to scale non-traditional use cases with data-driven insights contributing to safe driving for all, as well as customer acquisition, retention, and efficient claims handling at a fraction of the cost.

Integrating the Sentiance SDK in the app allows data collection and processing directly on the user’s smartphone, therefore addressing privacy concerns. Additionally, the minimal integration effort speeds up the time-to-market, and rather than relying on expensive IoT infrastructure, insurers can become more profitable and reduce their costs anywhere from 5-10x less.

2. Crash Detection for faster claims

There is no doubt that Sentiance’s Crash Detection saves lives thanks to its swift deployment of emergency services. However, there are additional advantages such as faster claims processing and handling. For example, detailed information concerning an accident helps prioritize incidents that are more likely to give rise to a larger claim and enable faster claims processing and settlement. This is both convenient for the end user and cost-efficient for the insurer.

It not only strengthens the user experience but also improves insurers' operational efficiency, evidenced by a 5% point improvement to loss ratio, as stated by the IoT Insurance Observatory.

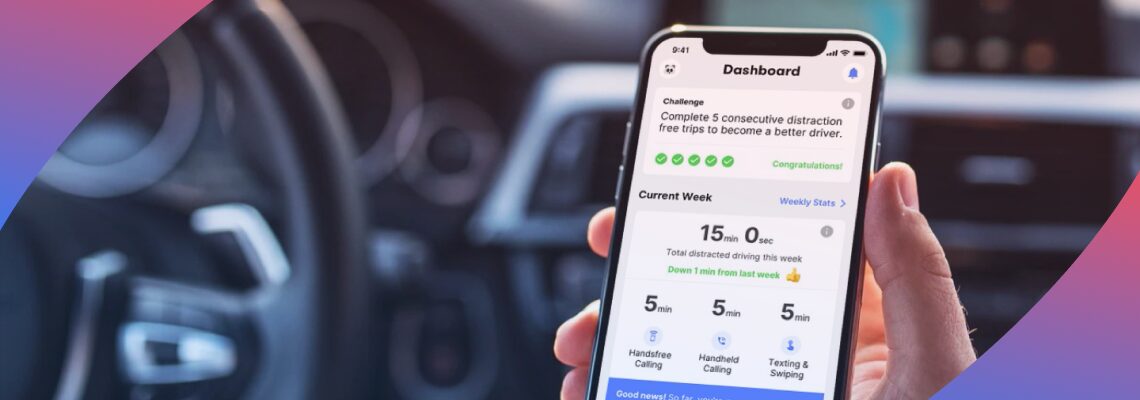

3. Engagement for behavior change

Embracing this change involves more than just providing telematics apps to all car, motorbike, and other transport modes policyholders. It requires a strategic and structured approach to behavioral change. Insurers can leverage the power of Sentiance’s data and driving insights to implement engagement features in their app and adopt individualized programs. This means better user experience, higher retention rates, encouraging better driving habits, and reducing the frequency of accidents on the roads.

Case studies: Real-world impact

Our client talabat, a leading delivery company in the Middle East, bolstered its safety-centric initiatives in 2023. This led to a staggering 56% decrease in incident rates by implementing an in-app telematics solution using the Sentiance technology and aligning operational processes with ongoing Road Safety Week campaigns.

Similarly, Progressive, one of the largest auto insurers in the US, strategically integrated telematics SDK into the apps of all their policyholders. This resulted in enhanced claim management, cost reductions, and improved loss ratios.

By transcending their existing book of business, insurers can proactively impact on a larger scale, contributing to safer roads worldwide. Using Sentiance’s on-device AI technology, giving your telematics app to all your policyholders, we estimate a 25-35% reduction in accidents among users.

Not only that, but adding as little as $5 a year per user (yes, we said a year!) can mean doubling the current underwriting profits of your average auto policy.

Conclusion: A call to action for safer roads

Adopting telematics broadly can lead to a significant decrease in accidents and double underwriting profits with minimal investment.

We invite insurers to explore the potential of extending on-device motion insights to all policyholders, paving the way for safer roads, more engaged customers, and a more profitable future. Get in touch!