Motor insurance is a staple in many markets, a high-volume engine-driving business for general insurers. With a strategic approach, this engine can be leveraged to boost profitability, renewal rates, and cross-sales for Home, Health, and Travel insurance, creating shared value for customers.

Building relationships, not transactions

The key to sustainable profitability lies in developing customer Lifetime Value (LTV) and building a profitable insurance book founded on shared value relationships rather than mere transactions. However, the lack of a compelling value proposition has made insurance seem like a grudging necessity rather than a beneficial service.

The power of engaged customer experience

A seamless and engaging customer experience, coupled with personalized products and pricing based on a data-rich safety proposition, can transform perceptions. Engaged customers build trust and loyalty at renewal times and are more open to considering cross-sold and up-sold products. Moreover, customer data can help identify high-risk drivers, reducing costly loss ratios.

Engaging insights from the Indian market

Our recent experience in the highly competitive Indian market has highlighted a trend toward verticalizing motor insurance to enhance engagement and conversion rates. Current propositions focus on universal needs for motorists: compliance (PUC certificates) and convenience (payment of challans and toll recharging). These approaches increase user sessions to bi-weekly, a significant improvement over the annual "grudge purchase."

Sentiance: Putting the user first

We prioritize the user over the vehicle. Since most drivers engage in daily trips, this presents frequent and meaningful engagement opportunities. Our personalized and relevant interactions delight users and promote safer driving behaviors, improving their driving scores—an essential risk metric.

Case study: RAC Western Australia pilot

In a pilot with RAC, the top car insurance and automobile club in Western Australia, Sentiance’s driving score effectively promoted safer driving. Here's what we found:

- 34% checked their scores after each trip, averaging 17 sessions per user per month—far surpassing the 2 sessions per user per month on vehicle-focused platforms.

- 75% of users participated in driving-focused challenges

- 60% improved their distracted driving habits.

- Retention was impressive, with over 60% of users active in the second month

- Push notifications had a 45% open rate, indicating strong user engagement.

👈 Click on the video to the left

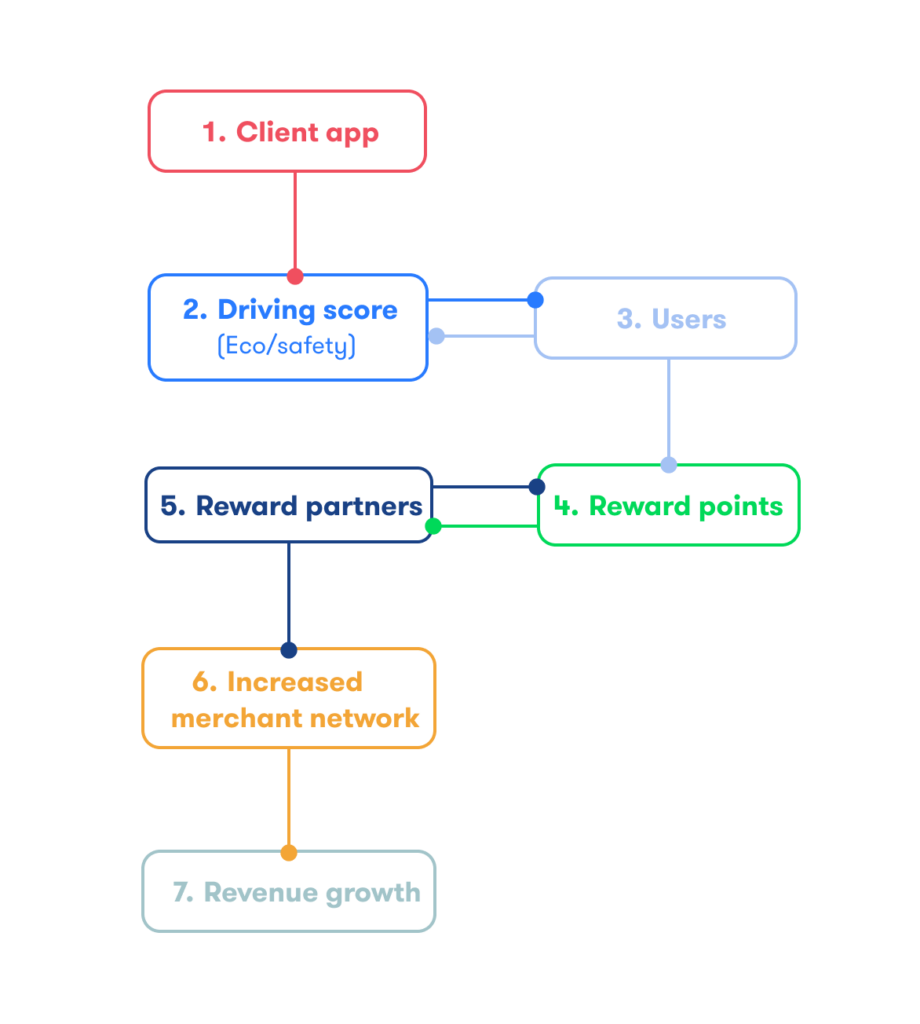

The action-reward framework

Market-leading engagement can be amplified with personalized communication and offers and by encouraging positive behaviors (interaction, safe driving, policy renewal) with an Action Reward Framework as illustrated:

- Client App: The central platform where users interact.

- Safe-Driving Score: Encourages users to drive safely and efficiently.

- Users: Engage with the app and improve their eco/safe-driving score.

- Reward Points: Earned by users for better eco/safe-driving scores.

- Reward Partners: Businesses where users can redeem their reward points.

- Increased Merchant Network: More merchants join due to increased user engagement and spending.

- Revenue Growth: Resulting from higher user engagement, expanded merchant network, and increased transactions.

Significant underwriting improvements

Our driving score isn't just an engagement tool; it's a powerful risk metric. The driving score's impact extends to underwriting. For instance, ABSA, one of South Africa's largest insurance companies, used it to shift from proxy metrics like age and gender to more accurate measures of risky behavior (e.g., night-time driving), improving their loss ratio by 8.3%.

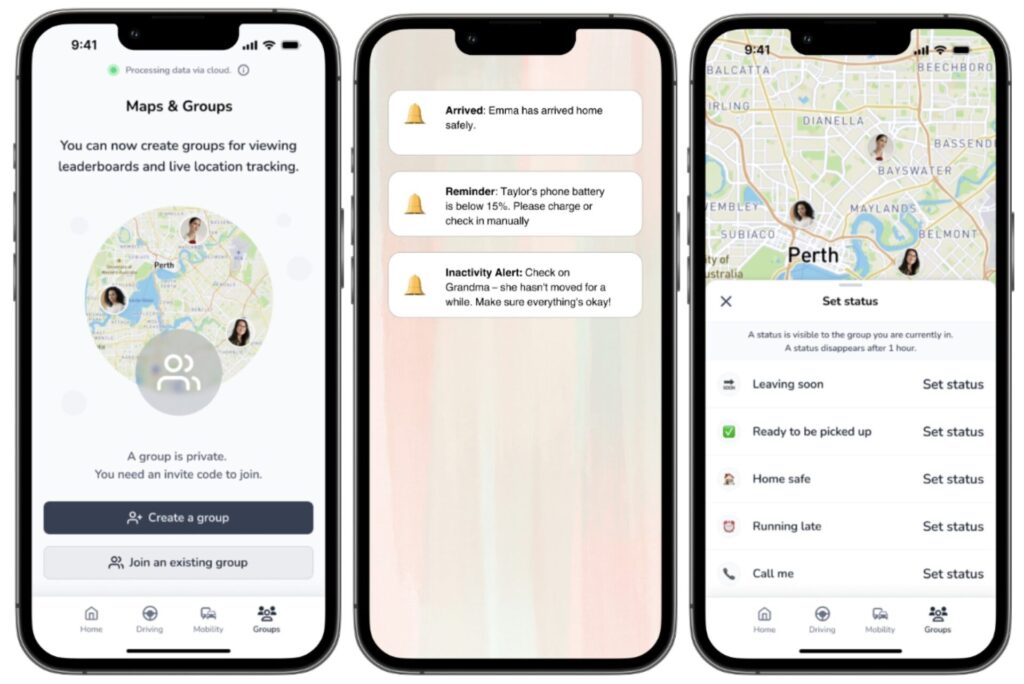

Expanding beyond motor insurance

Building on our driving insights platform, Sentiance has developed a comprehensive Family Safety product, encouraging daily use beyond motoring. You can stay connected with real-time location sharing and stay informed with family alerts. This high engagement level builds trust, opening cross-sell opportunities for Home insurance/security and Health products.

Embedding Sentiance in the insurance lifestyle: Shared value for an enduring business

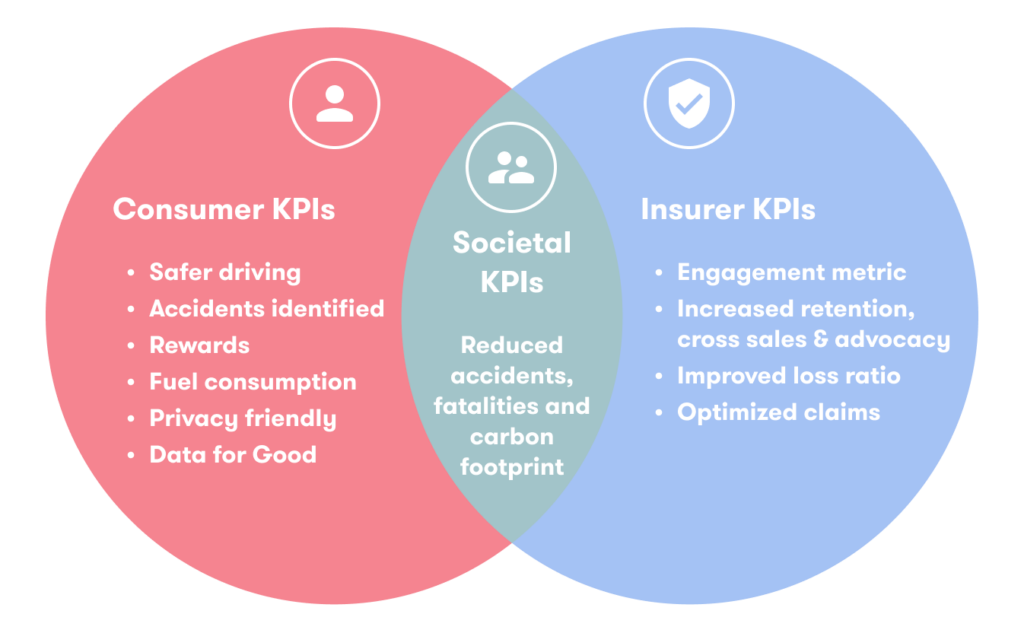

Ultimately this holistic approach delivers shared value: Promoting safe driving reduces fatalities, rewards safe drivers with personalized pricing (supporting renewals), and improves loss ratios, forming the bedrock of a sustainable insurance book.

Integrating Sentiance into the general insurance lifecycle delivers tangible business value through enhanced Customer Experience, improved Margins, and better Risk management. By fostering shared value for customers, insurers, and society, we lay the foundation for enduring business success.